Let’s look a little more closely at Mr. “I don’t benefit. I don’t benefit”.…

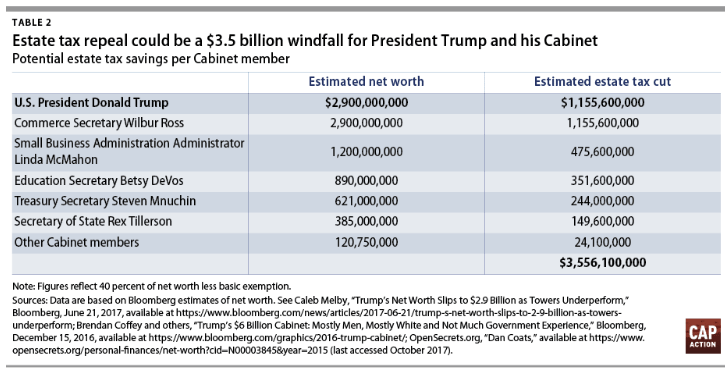

He would save $1.1 billion dollars from repealing the estate tax. And it’s true, just Ivanka, his two horrid older sons, Barron and that other daughter would get this

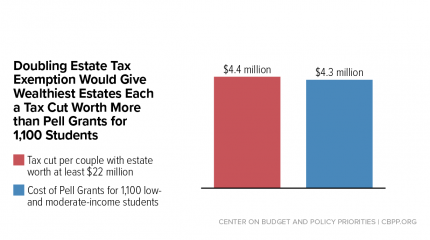

Just doubling the exemption of the Estate Tax is obscene. Removing it in 6 years is even worse.

As it is, only 0.2% of estates pay any estate tax. The largest estates consist mostly of “Unrealized” capital gains that have NEVER BEEN TAXED. This is the most progressive part of the U.S. Tax Code.

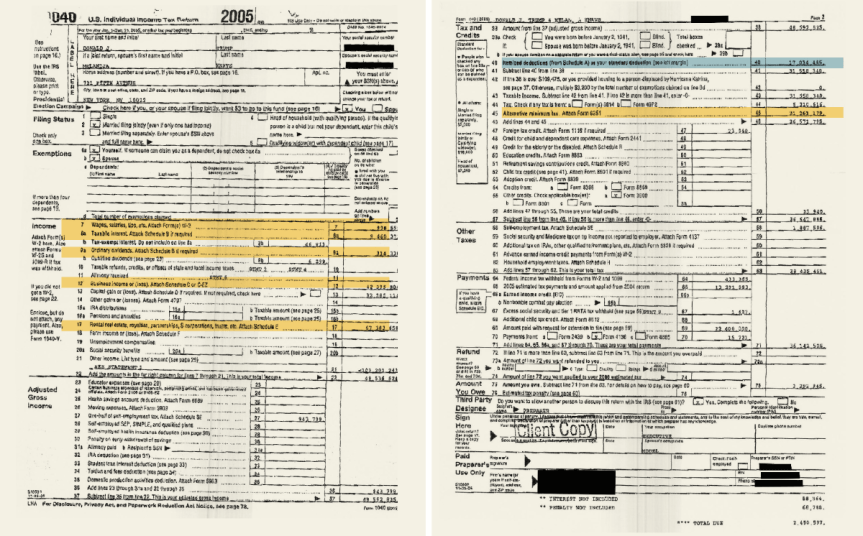

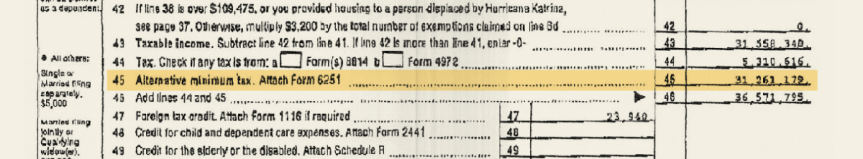

However, he would also save $31 million from repealing the Alternate Minimum Tax. Repealing this will drain $440 billion dollars from the Treasury in the first decade/

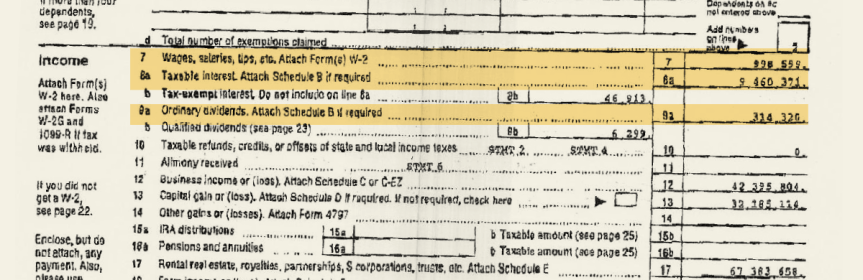

He would save $16 million from taxing pass-throughs at 25%. This tax cut will be the biggest driver our bouncing baby new deficit, costing over $770 billion over 10 years. This is gravy for the wealthiest people in our country and one of the issues that toppled the economy of Kansas.

If Congress cuts the highest tax rate from 39.5% to 35%, he save a cool half million.

He would lose $3-5 million if Congress repeals his favorite deductions. But we think there’s some nice compensating factors already discussed above.

Unsure of how much he’s save from the GOP just gutting a proposal to tax U.S. companies’ payments to related foreign affiliates, part of a package of late changes on Monday that punched a $74 billion revenue hole in their tax-overhaul plan.

Trump isn’t the only one who think we’ll do anything, give up anything, for a small tax cut. God, with a $1000 dollar tax cut, we can buy a new car or remodel our kitchen, still not pay for our medical out-of-pocket deductibles, which are shooting up, thanks to him.

Thank goodness Trump is throwing the poor rich a bone, or else nobody would be winning here.

Oh, yes. He thinks we’re idiots.