(Quote from Trump, and American Progress) (top)

The only change from her advice is to contact your SENATORS.

(https://youtu.be/2dEX7q8MvEA?si=hn5iY_i_Qjqols2T)

- Basic calls/emails

- Items that SHOULD be in the bill because they would save lots of money

- Items that have NOTHING to do with the budget

- Items that hurt working and middle class people

- Items that hurt our economy and environment

- Items that hurt immigrants

- Items that promote Project 2025’s agenda

- Items that help rich people get richer

- Items that are gifts for Trump

- How do I contact my federal legislators?

- What can I do besides calling my own legislators?

- What are effective messages to share?

- How will people in my state be affected by H.R.1?

BASIC CALLS/EMAILS

- (5calls.org) They have a nice email you can copy and send for the whole H.R.1

- (Patreon.com) Hi, I’m calling from [zip code] and I’m calling to urge [SENATOR’s NAME]to do everything possible to stop business in the Senate. Object to every unanimous consent request, demand votes whenever the rules allow, do not waive any debate time. Our Republic is under attack, these are not normal times, and you must do everything you can to slow MAGA’s destruction of our country. Every day that you delay the Senate is a day that 80 million Americans who rely on lifesaving medical care from Medicaid do not die preventable deaths because Medicaid funding is slashed, every day that you delay is a day that 42 million Americans who rely on SNAP don’t starve because SNAP is slashed.

- (5calls.org) Hi, I’m calling from [zip code] and I’m calling to urge [REP/SEN NAME] vote against House-passed H.R. 4, the Rescissions Act of 2025, that will cut funding for the Corporation for Public Broadcasting, NPR and PBS. Money for NPR and PBS is well-spent on valuable news, information, and educational programming for the American public, especially in rural and underserved areas.

- (5calls.org) Hi, I’m calling from [zip code] and I’m calling to urge [REP/SEN NAME] vote against House-passed H.R. 4, the Rescissions Act of 2025, that will drastically cut USAID and foreign aid funding. These humanitarian programs are life-saving for millions of people around the world and need to be preserved.

ITEMS THAT SHOULD BE IN THE BILL BECAUSE THEY WOULD SAVE LOTS OF MONEY!:

OVERALL ACTION CALL – Let’s save $2 trillion dollars right now! I’m calling from [zip code] and I want [legislator’s name] to follow Senator Elizabeth Warren’s letter full of 30 suggestions to actually cut waste, abuse and fraud without taking health care and food from needy Americans. They include the possibilitiy of canceling Medicare Advantage as a costly scam that it is, cutting waste from the Department of Defense (DoD), and stop funding federal Charter Schools and for-profit colleges.

And why would we cancel investments that make us money?: Fully funding the Internal Revenue Service (IRS) to crack down on wealthy tax cheats is a great investment. Funding the NIH is also a great investment that supports the biomedical research, the resulting economic activity and millions of jobs.

We could also save billions by NOT deporting non-criminal undocumented people, which would also help our economy, and to pass a war powers resolution so we don’t lurch into another hugely expensive war to distract us from Trump’s unpopular actions. Oh, and don’t extend the 2017 Tax Scam components that siphon whatever we have up to the insanely wealthy.

(Facebook link with Sen. Warren explaining her policy: https://www.facebook.com/reel/638760082514748/?s=single_unit

- PASS THE WAR POWERS RESOLUTION – ACTION CALL! “I’m calling from [zip code] and I want [legislator’s name] to pass a War Powers Resolution to prevent our country from entering into a war with Iran. This is just a diversion to keep us from noticing how bad this budget bill is for the average constitutent, and the economic havoc caused by his tariffs. No diversion should cost lives, and billions of our money.”

- War with Iran is costing Israel nearly $1 billion daily. Back in 2012, it was estimated that

an all-out U.S. war with Iran, including an invasion by American troops, would cost the global economy close to $2 trillion in the first three months and could go as high as $3 trillion. Now there’s a question if the US could even afford a war with Iran. The wars in Iraq and Syria cost the American taxpayer $2.9 trillion, and the Afghanistan war cost another $2.3 trillion. (Watch the video here) (5calls.org action)

- War with Iran is costing Israel nearly $1 billion daily. Back in 2012, it was estimated that

- ELIMINATE MEDICARE ADVANTAGE – This is an experiment which has not only failed to deliver its promised savings since its inception, but has in fact, bilked American taxpayers of over $83 billion dollars in 2024 alone and and almost $600 billion over the last 17 years because of the high administrative costs inherent in the program

- STOP DEPORTING NON-CRIMINAL UNDOCUMENTED IMMIGRANTS – The cost to the government, not counting sending in troops, is estimated at $88 billion/year. This does not count the economic devastation caused of mass deportations, including the hit to GDP of $1.1 trillion to $1.7 trillion. Governments would also see tax revenues fall, as they would lose the $46.8 billion in federal taxes paid by undocumented immigrants and a $29.3 billion in state and local taxes. The most impacted states would be California, Texas, and Florida, although every state would see a loss in population. (Costs here)

- FUND NIH – “NIH funding is the best Return On Investment for any government spending at 2.4-fold. Nationally, $47B from NIH directly supports more than 400,000 jobs and fuels a $1.55T pharma and biotech industry with perhaps another 2-3M jobs.”

- CUT WASTE FROM THE DEPARTMENT OF DEFENSE – Re-up the “Stop Price Gouging the Military Act” and utilize the suggestions in Sen. Warren’s letter to save $10 trillion over the next 10 years.

- FULLY FUND THE IRS – Fully funding the Internal Revenue Service (IRS) is an amazing investment, with a 12:1 return on investment by cracking down on wealthy tax cheats. The GOP’s slashing of IRS funding is estimated to result in $2.4 trillion in lost revenue over the next decade.

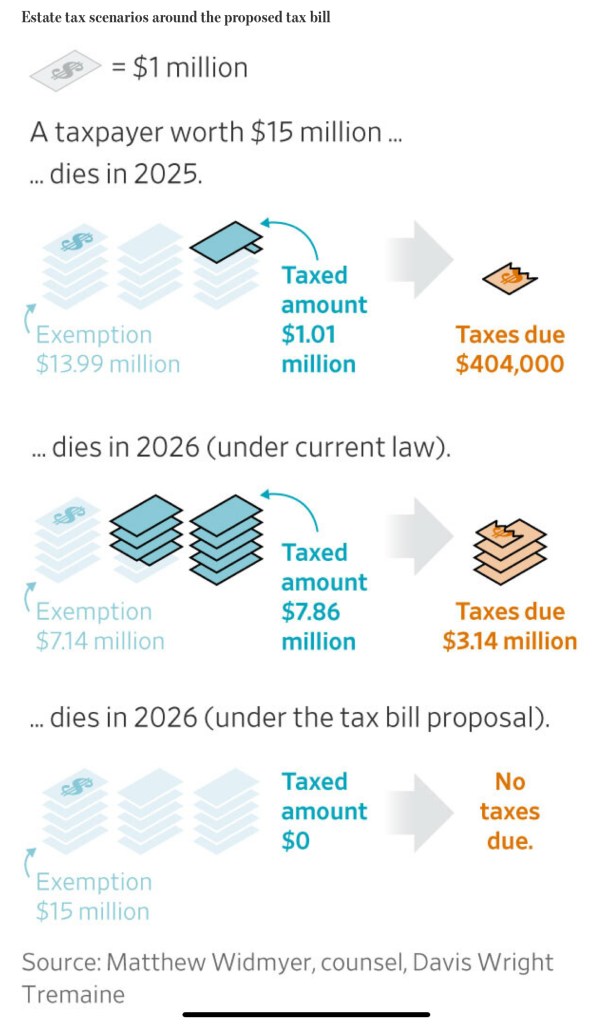

- DON’T EXTEND TAX BREAKS FOR THE WEALTHY – “…the tax cuts are $500 billion more expensive than extending the 2017 law through 2034: $3.8 trillion versus $3.3 trillion.” It includes a larger estate tax exemption, more deductions for pass-though businesses like Trump’s, permanent tax cuts from the 2017 tax law with windfalls for shareholders, and expanded tax shelter opportunities.

- SELL THE QATARI PLANE FOR SCRAP -Not only is it an obvious violation of the emoluments clause, according to Rep. Joe Courtney, D-Conn., “it would cost about $1 billion to strip down the Qatar plane, install encrypted communications, harden its defenses and make other required upgrades.” Plus, that investment goes out the window when Trump takes it for his private library in 3 years. The Qataris have been trying to sell this gas-guzzling white elephant since 2020 for $400million with no takers. Maintenance and storage are expensive and it’s so big, landing areas are limited too.

- LIMIT TRUMP’s GOLFING ON OUR DIME: During the run-up to his first term, Trump said he was a rich man. Not only did he say he’s refuse a salary, but he also promised never to play golf if elected. However, during his first term as President, “[he] visited a Trump Organization property on 428 (nearly one in three) of the 1,461 days of his presidency and is estimated to have played 261 rounds of golf, one every 5.6 days” Wikipedia, Trump and Golf, costing us taxpayers $151.5 million dollars. For his second term, he’s already “golfed 37 out of his first 152 days in office. That is nearly a quarter — 24.3% — of his time during this second term out on the golf course. The bill for that comes in at a whopping $51,800,000.” Almost $52 mill. The U.S. Chemical Safety and Hazard Investigation Board, which he is eliminating, only had a budget of $14 million. Meanwhile, he has only sat for 12 daily briefings since January.

(top)

ITEMS THAT SHOULD NOT BE IN THE BILL BECAUSE THEY DON’T AFFECT THE BUDGET

ACTION CALL: I’m calling from [zip code] and I want [legislator’s name] to demand the removal of all the GOP’s poison pills that do not belong in a budget bill. These include a paragraph on not allowing any regulation of AI for 10 years, limits on federal judges, the REINS Act, and the failed HR 9495, the “Stop Terror-Financing and Tax Penalties on American Hostages Act.” There may be more, but their intent is to deceive us, like when they slipped that tax clause into the COVID relief bill that benefitted Trump. ENOUGH OF THEIR DIRTY TRICKS!

(Facebook links: (https://www.facebook.com/IndivisibleVentura/posts/pfbid02D7tmFNTvACXwZJTUy7ovVsnHYbZB5UDUYnv57DVvu7Uaz6KG1kUQ6tvWUte7a5vnl)(https://www.facebook.com/IndivisibleVentura/posts/pfbid02GNPZyB8vXNZ34mQk8tjjUH1JusjaovfxLrVVgzovcsvj7phSDKdSLyuDTyeXwZURl)

- AI REGULATIONS: Requiring states block all AI regulation for 10 years in order to receive federal broadband funding (https://fb.watch/zFe-j8lz7U/) States across the country have stepped up and enacted safeguards, such as prohibiting AI from being used to intentionally deceive voters and requiring disclaimers. A 10-year ban on enforcing AI laws across the country could mean a decade of false information that undermines voters’ right to make informed decisions.

- RESTRICTIONS ON JUDGES: Stripping judges of power to enforce contempt of court and requiring bonds (Section 70302) language and Resistbot (THIS MAY HAVE BEEN REMOVED BY THE BYRD RULE, but could be overridden! (See video immediately below)

- REMOVING REGULATIONS FOR CORPORATIONS: (Slate) the REINS Act, to help the American Petroleum Institute (API) destroy CA’s clean air standards. This was nixed in the final bill but could come back.

- TRUMP GETS TO DESIGNATE NON-PROFITS AS TERRORISTS: (Slate) (Yahoo) The failed HR 9495, the “Stop Terror-Financing and Tax Penalties on American Hostages Act” which would allow Trump unlimited powers to designate any non-profit his demented, vengeful mind decides is a supporter of terrorism through his servants in the Treasury Department. We wrote a post on it.

(top)

ITEMS THAN WILL HARM WORKING AND MIDDLE CLASS PEOPLE

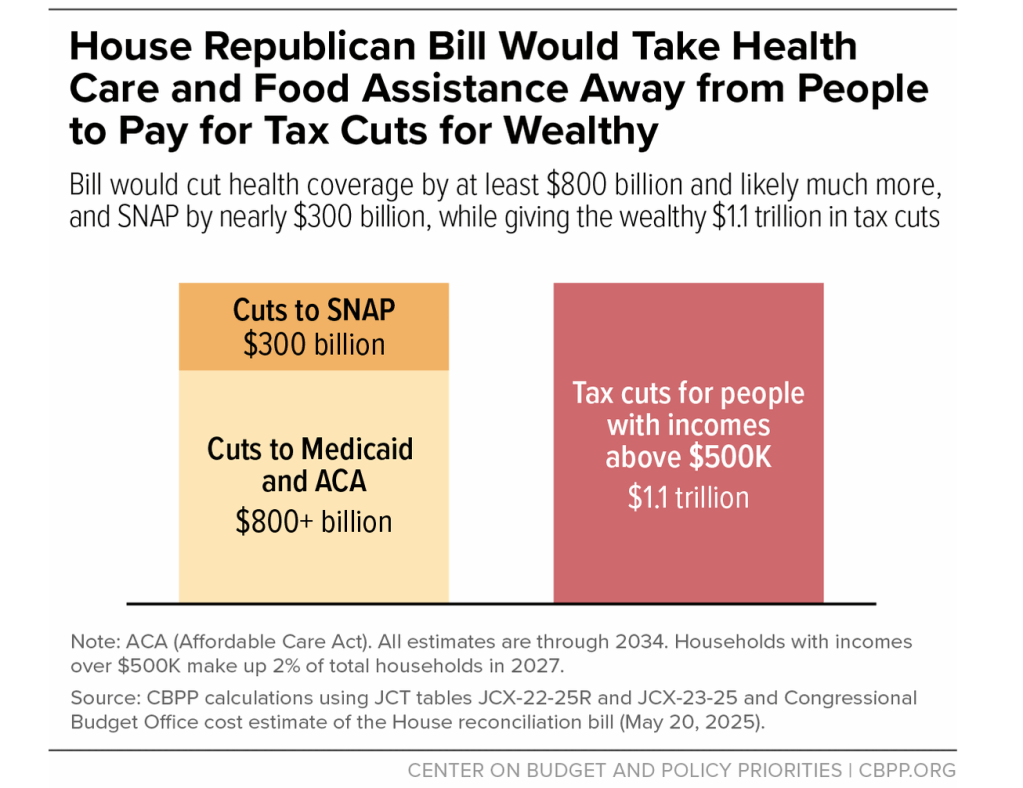

- DEEPEST CUTS TO MEDICAID EVER – Deep cuts to Medicaid, including harsh new work requirements, closed hospitals – Medicaid work requirements language and Resistbot, Medicaid cuts phone script, for those with GOP reps: use this tool.

- MEDICAID for LONG-TERM CARE – Eliminate Medicaid coverage for long-term care for people whose home is worth more than $1 million

- DEFUND MEDICAL CARE – Funding cuts to clinical care services at Planned Parenthood and gender-affirming care for Medicaid and CHIP recipients

- SNAP/DENYING FOOD ASSISTANCE TO 11 MILLION– Unprecedented funding cuts and expansion of work requirements for SNAP – SNAP cuts email language and Resistbot (Cost

- THRIFTY FOOD PLAN – Limit increases to the plan used to set food benefit levels

- TAX CREDITS – Failing to extend premium tax credits for Affordable Care Act language and Resistbot

- HIGHER INSURANCE RATES FOR EVERYONE! – Killing the enhanced ACA premium tax credit will cause “payments will go up by 75% on average, in 12 states people would see their premium payments literally double, and 4 million people will lose coverage altogether.” Call and email action here.

- EITC “PRE-CERTIFICATION – “…millions of low- and moderate-income families will have to apply for “pre-certification” for each child for every year in which they claim the EITC, including supporting documentation, or forgo the refundable portion of the credit. Even as the bill would impose new filing burdens on non-wealthy people, Trump Administration cuts in IRS staffing are undermining the agency’s ability to audit the returns of wealthy people.

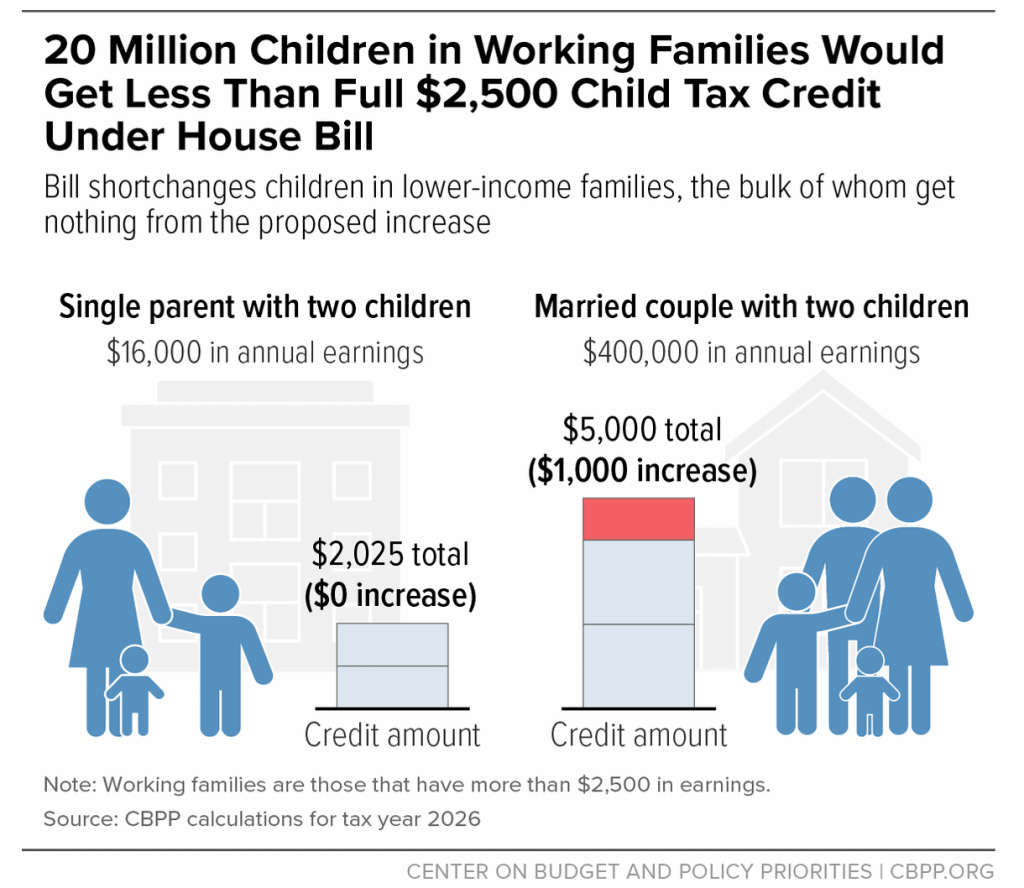

- CHILD TAX CREDIT – This bill will block as many as 20 million children in working families from receiving the full $2,500 Child Tax Credit included in the bill because their parents don’t earn enough

- STUDENT COSTS INCREASE – Widespread changes to student loan access, protections, and repayment options, including eliminating subsidized loans and grad PLUS loans, cap parent PLUS loans and amend undergraduate loan limits, and limiting income-driven repayment options.

- HIGHER UTILITY BILLS – Eliminating the clean energy tax cuts from the Inflation Reduction Act language and Resistbot

- HIGHER TRANSPORTATION COSTS – Repeal of clean vehicle and energy credits & rollbacks in clean vehicle standards, will cost families to spend hundreds more at the gas pump every year—a windfall of tens of billions of dollars in additional revenue for the oil companies over the next 10 years. It also adds an extra $250 annual fee on people who already own an EV and $100 for hybrid car owners.

- DESTROYING CONSUMER PROTECTIONS – Slashes to funding for the Consumer Financial Protection Bureau (CFPB) by nearly 70%

- DESTROYING WORKER BENEFITS – Harmful changes to federal worker pay, benefits, unions, and protections against unjust treatment. Example: Require workers and former workers to pay filing fees when they make complaints, new federal employees would either give up some civil service protections or be asked to pay more for their retirement accounts.

- DESTROYING OUR SCHOOLS – Instituting a national private school voucher program that diverts funding from public schools and sets up a new tax shelter for the wealth

- DESTROYING OUR ENVIRONMENT – Widespread rollback of climate protections. Rollback of the Inflation Reduction Act’s clean energy investments will endanger air, water, and land with increased drilling, kill clean energy jobs, destroy our air quality, and increase our vulnerability to extreme weather events. Action call here.

- DESTROYING OUR ACCESS TO NATURE – Authorization for the sale of public lands and increased incentives for fossil fuel production

- RESCISSION OF FUNDS: Eliminate funding for sustainable aviation fuel, neighborhood access and equity, green federal buildings, environmental reviews and low-carbon transportation material grants

(top)

ITEMS THAT HURT OUR ECONOMY AND THE ENVIRONMENT

Here’s the economic argument.

ACTION CALL – “NO” on the sale of public lands: I am calling from [zip code] and I want [legislator’s name] to vote “NO” on the budget reconciliation bill provision authorizing the sale of public lands. Our public lands are our national treasures, which should be protected and preserved for our children and grandchildren. Instead, our inheritance is being stolen from us – to be destroyed by the fossil fuel industry or sold off to fund tax breaks for billionaires and corporations.

It is no wonder it’s being called the ‘Environmental Liquidation for Billionaires Act.’

- Watch this ferocious speech here: https://fb.watch/zFiUGAyJ7U/

- 5 Calls has a good fast description: https://5calls.org/issue/public-land-sales-budget-reconcilliation/

- TAKING AWAY ENERGY TAX CUTS – Eliminating the clean energy tax cuts from the Inflation Reduction Act language and Resistbot

- REMOVE $800 EXCEPTION ON IMPORTS – Repeal the privilege, which currently allows shipments under $800 to enter the U.S. duty-free

- DESTROYING CONSUMER PROTECTIONS – Slashes to funding for the Consumer Financial Protection Bureau (CFPB) by nearly 70%

- DESTROYING OUR ACCESS TO NATURE – REQUIRES the mandatory sale of public lands and increased incentives for fossil fuel production

UPDATE: The parlimentarian in the Senate as smacked Senator’s Lee’s attempt to sell off our lands to the GOP’s donor class. He’s not going away…he’s trying to tailor the language so it just sounds like it for housing. It’s not over…Land sold can have its uses changed by private owners.

(Axios)“Catch up quick: Lee’s proposed land sale prompted widespread backlash, including from some Republicans.

Lee said the land sales would make room for more housing in western states — but the policy language didn’t require homes built on the land to meet any standard for affordability.

The intrigue: Shortly before the parliamentarian’s ruling, Lee posted to X that he planned to make major revisions to the proposal, making national forest land ineligible for sale and “significantly” reducing other lands that would be available.”

(top)

ITEMS THAT HURT IMMIGRANTS

ACTION CALL – Deportations to El Salvador prison violate the 8th Amendment: “I’m calling from [zip code] to ask [legislator‘s name] to do whatever’s necessary to prevent our taxes from being used to fund violations of the Eighth Amendment‘s prohibition against cruel and unusual punishment.

We are not at war with Venezuela, nor are Venezuelan immigrants being transferred due to a legitimate extradition request. Instead, we are denying them due process, and shipping them to a foreign country’s prison system known for torture and inhumane conditions. This is both cruel and unusual, and using $6 million dollars of our money to do it makes us complicit in both a violation of our own constitution and of crimes against humanity. President Trump’s has publicly stated that he wants to disappear American citizens this way as well, and we want Congress to shut this lawlessness down now.”

- DEPORTATION IS A HUGE COST – Massive increase in funds for deportation machine script and Resistbot language, plus email tool from the National Immigration Law Center Breakdown, and cost comparison to helpful things here:

- $46.5B for border barrier construction

- $45B for adult and family detention

- $15B to beef up ICE”s capacity to deport migrants.

- $16.2B to hire new ICE, CBP, and Border Patrol Agents

- $12B to reimburse states (mostly TX) for past boer security spending.

- EXCISE TAX ON MONEY SENT ABROAD – Impose new excise tax on remittance transfers by those who are not U.S. citizens or U.S. nationals

- SCREEN OUT IMMIGRANTS FROM HEALTH CARE – Prevent states from enrolling people in Medicaid until their citizenship status can be confirmed

- HIGHER FEES – Set higher fees for certain travel, work authorization and asylum applications, raising revenue to fund enforcement

- SNAP – Limit benefits to citizens or lawful permanent residents

- MEDICARE COVERAGE: Limit eligibility to green card holders and certain other immigrants (current law includes all who are “lawfully present”)

(top)

ITEMS THAT PROMOTE PROJECT 2025’s CHRISTOFASCIST AGENDA.

I’m calling from [zip code] and I want [legislator’s name] to veto any budget bill that includes the removal of funding for the LGBTQ Youth Specialized Services arm of 988. It costs less than Trump’s proposed birthday present to himself and it actually saves the lives of our kids, each one being of much higher value than his ludicrous military parade or tax cuts to billionaires.

Facebook link: (https://www.facebook.com/IndivisibleVentura/posts/pfbid029Mh4QSWDGwwjxd3iqqZWLvGrS6rEPC6WydPPoJsXpFXbftKkpiWNANnKFnqT3FB7l)

- ATTACKS ON GENDER-AFFIRMING CARE – Call script language here

- ATTACKS ON PUBLIC SCHOOLS – phone script here This creates a national private school voucher program that diverts funding from public schools and sets up a new tax shelter for the wealthy

- MORE GUN DANGER – Elimination of a tax and some regulations on gun silencer sales

- DEFUNDING PLANNED PARENTHOOD – Defunding Planned Parenthood email tool

- SCREWING OVER WORKERS – Harmful changes to federal worker pay, benefits, unions, and protections against unjust treatment

- DEFUNDING CLIMATE PROTECTIONS – Widespread rollback of clean energy tax incentives and climate protections

- SHIFT MORE MONEY TO THE MILITARY – Trillion dollar Pentagon budget and billions for Elon Musk phone script

(top)

ITEMS THAT HELP RICH PEOPLE GET RICHER

- RAISING THE DEBT LIMIT: Raising the debt limit by $5 trillion purely to fund tax cuts for the wealthy, adding trillions to the national debt.

- ATTACKS ON PUBLIC SCHOOLS – phone script here This creates a national private school voucher program that diverts funding from public schools and sets up a new tax shelter for the wealthy

- TAX CUTS THAT BENEFIT THE WEALTHY:

- Extensions and expansions of 2017 Tax Cuts and Jobs

ActScam (TCJA) provisions:- Estate Tax: doubled the estate tax exemption, allowing wealthy individuals to pass on a larger amount of their assets tax-free to their heirs. Some proposals want to increase this.

- Extensions and expansions of 2017 Tax Cuts and Jobs

- Pass-Through Business Deduction: allows owners of certain businesses to reduce their tax liability on their business income, with a significant portion of the benefits going to high-income owners.

- Lower Top Income Tax Rate: lowered the top marginal income tax rate, primarily benefiting the wealthiest taxpayers.

- Opportunity Zones: allows investors to shield capital gains from tax by investing in designated low-income areas. Taxpayers with capital gains are “highly concentrated” among the wealthy.

- SALT DEDUCTION: Proposals to raise the State and Local Tax (SALT) deduction cap disproportionately benefits high earners.

- CORPORATE TAX BREAKS:

- Permanent Corporate Tax Rate Cut: significantly reduced the corporate tax rate, with benefits primarily flowing to corporate shareholders, many of whom are wealthy individuals.

- Corporate Welfare/Subsidies: direct grants, below-market insurance, and tax breaks, which can benefit large corporations and their wealthy stakeholders.

- Weakening of Alternative Minimum Tax (AMT): The 2017 tax law weakened the AMT, reducing the tax burden for many high earners, particularly those in high-tax states.

- OTHER TAX BENEFITS:

- Health Savings Account (HSA) Expansion: HSAs offer tax advantages for medical expenses, benefiting high-income individuals who are better able to contribute and benefit from the tax deductions.

- Tax-Deferred Investments: Wealthy individuals can utilize strategies like borrowing against their investments or using certain types of retirement accounts to defer taxes on their investment income.

- (CAP) The House Republicans’ Budget Bill Guts Basic Needs Programs for the Most Vulnerable Americans to Give Tax Breaks to the Rich

(top)

ITEMS THAT ARE GIFTS FOR TRUMP

- PUNISH LEAKERS OF TAX INFORMATION – A provision tucked near the end of the GOP’s massive budget bill — at page 1,081 of the 1,082-page text circulated late Sunday — would double the maximum prison sentence for leaking tax returns to 10 years and increase possible fines from $5,000 to $250,000 per violation.

- PRESIDENTIAL PROTECTION: Fund reimbursements to local law enforcement for protecting the president’s private residences

(top)

FEDERAL CONTACTS

- Rep. Julia Brownley: email, (CA-26): DC (202) 225-5811, Oxnard (805) 379-1779, T.O. (805) 379-1779

- or Rep. Salud Carbajal: email,(CA-24): DC (202) 225-3601, SB & Ventura: (805) 730-1710 SLO (805) 546-8348

- Senator Adam Schiff: email, DC (202) 224-3121, LA (310) 914-7300, SF (415) 393-0707, SD (619) 231-9712, Fresno (559) 485-7430

- and Senator Padilla: email, DC (202) 224-3553, LA (310) 231-4494, SAC (916) 448-2787, Fresno (559) 497-5109, SF (415) 981-9369, SD (619) 239-3884

- Who is my representative/senator?: https://www.usa.gov/elected-officials

(top)

WHAT CAN I DO BESIDES CALLING MY OWN LEGISLATORS?

- I/MY FRIENDS/MY FAMILY HAVE A REPUBLICAN REP – What can I/they do?

- CALL NOW: Hold Your Republican Representative Accountable For Voting to Slash Medicaid & SNAP

- EMAIL: Hold Your Republican Representative Accountable For Voting to Slash Medicaid & SNAP

- CALL NOW: CALL NOW: Tell your Republican Senator(s) You Don’t Want To Pay The Price For Their Billionaire Tax Breaks

- DEMOCRATIC OR REPUBLICAN LEGISLATOR – How can I expand my reach?

- Indivisible will help you share information on how to take action with 5 like-minded neighbors with their Neighbor2Neighbor project.

- Empower: Fight Back With Friends

- SHARE STORIES OF HOW PROGRAMS TARGETED IN THIS BILL HAVE IMPACTED OUR LIVES

- Tips on how to shape our stories from Vote Save America here

- Submit our stories to the People’s Action Institute here

- And of course we can share our experiences on social media, with our own or friendly members of Congress as well and our local media outlets as well!

- WRITE LETTERS TO THE EDITOR

- PRESSURING THE MEDIA

- PHONEBANK FOLKS IN KEY CONSTITUENCIES

- MONDAY

- 2PM PT with Medicaid Defenders, sign up here (starting 6/9)

- TUESDAY

- 11AM-1PM PT with BlueVote.org, sign up here (weekly)

- 3:00 – 5:00 PT Moveon Phone Bank to Save Medicaid here

- 2:30PM-7:30PM PT with Together for CA Health, sign up here

- 2:30PM-7:15PM PT with Grassroots Democrats HQ and Chop Wood, Carry Water, sign up here

- WEDNESDAY

- THURSDAY

- FRIDAY

- 10AM-11AM PT with Citizen Action Illinois, sign up here

- SATURDAY

- SUNDAY

- 10:30AM-3:30PM PT with Together for CA Health, sign up here

- MONDAY

(top)

EFFECTIVE MESSENGES TO SHARE WITH OUR FAMILIES AND FRIENDS

Yes, continuing to educate people around you on the effects of the budget bill CHANGES MINDS!

Here are two examples from KFF.

————————————————————————————————

- The bill cuts services working people rely on to pay for tax cuts for billionaires. The rich will get richer, and low-income families will get poorer.

- Americans who make less than $51,000 a year will see after-tax income fall $700-$1000 after 2026. Americans in the top 0.1% of income will see after-tax income rise more than $389,000. (Penn Wharton)

- More than half the benefits of extending the Trump tax scam will go to people making more than $450,000 a year (Tax Policy Center)

- “Household resources would fall by about 2 percent of income for the lowest-income 10 percent of households by 2027, and 4 percent by 2033… the top 10 percent of households would see their household resources rise 4 percent by 2027 and 2 percent in 2033” (CBO preliminary analysis, 5/20)

- The bill will raise the price of things regular Americans need

- The bill will kick millions of Americans off their health insurance and raise the cost of health care for millions more – and will cost lives

- At least 15 million will lose health insurance and become uninsured by 2034 (CBPP, 5/1)

- 7.6 million people will be kicked off Medicaid and become uninsured (CBO)

- 3.9 million people will become uninsured due to changes to Affordable Care Act marketplace rules (CBPP, 5/1)

- 4.2 million people will lose insurance due to the expiration of the Affordable Care Act premium tax credits (Urban Institute). Premiums will rise by 75% for 20 million more enrolees (KFF).

- The bill will add so much to the deficit it will trigger $500 billion in automatic cuts to Medicare (CBO)

- At least 15 million will lose health insurance and become uninsured by 2034 (CBPP, 5/1)

- The bill will take food off the table for millions who rely on SNAP

- 6 million people would be at risk of losing food assistance entirely. 11 million households, 1 in 4 people on SNAP, would be at risk of losing some benefits. (CBPP, 4/30)

- An average SNAP households could lose more than $1200 a year (CAP, 5/5)

- The clean energy/IRA tax credit rollbacks will raise your energy bills and kill jobs

- Household electric costs will rise by an average of $113 by 2026 (CAP, 5/5)

- The bill will explode the deficit

- The CBO estimates the legislation will increase the debt by $2.3 trillion over the next 10 years.

- This would be enough to trigger PAYGO rules that would automatically cut Medicare by almost $500 billion (CBO)

- Penn Wharton estimates it would raise the debt by $3.3 trillion over the next 10 years

- The CBO estimates the legislation will increase the debt by $2.3 trillion over the next 10 years.

- Navigator Research on Do’s and Don’ts of Talking About Medicaid and SNAP Cuts

(top)

HOW WILL PEOPLE IN MY STATE BE AFFECTED

- District-by-district stats on how many people will be hurt

- Dashboard on Medicaid reliance by district

- How many people in our district benefit from SNAP

- State Impact Sheets

- How many jobs will be killed

- The cost for family budgets

- How GOP districts are benefiting from the Inflation Reduction Act

(top)

SOCIAL MEDIA CONTENT

- From DemCast

- From The Century Foundation

- From Freedom Writers Collaborative

- From Food Research & Action Center

- From Americans for Tax Fairness

- From the Into Action Content Library

- List of Bill actions