It’s the weirdest thing…

- On the one hand, banks profit by lending us money to buy homes. To build hospitals. To create communities.

- On the other hand, banks profit by lending hundreds of billions to a fossil fuel industry that contributes to making those same homes uninsurable. That makes us sick or kills us. That destroys our communities.

You’d think that the banks would notice that one of their activities was actively destroying the other, but apparently government intervention is necessary to stop their endlessly expanding mobius loop of profit extraction.

Action #1 – Tell Congress to support the H.R.2443/S. 1138 – Fossil Free Finance Act

Minimal call or email script to your representative and senators: I’m calling from [zip code] and I want Rep./Sen. [____] to know that I want them to support to [Rep. – H.R.2443/Sen. – S. 1138 – Fossil Free Finance Act]. {Tell your elected officials how you and your loved ones have been affected by climate extremes this summer and why you want the big banks to be required to stop financing climate chaos. You could also mention climate change-fueled disaster in Maui, with a current death toll in Maui of 111 Americans, including children.}

Cosponsors:

- H.R.2443: Neither Reps. Brownley nor Carbajal are on this.

- S.1138: Neither Sens. Feinstein nor Padilla are on this yet.

Contacts

Deeper Dive

What would this bill do?

H.R.2443/S. 1138 – Fossil Free Finance Act would require that all banks holding more than $50 billion in assets and all nonbank “Systemically Important Financial Institutions” (SIFIs) More detailed information here.

- reduce financed emissions by 50 percent by 2030 and cease financing emissions by 2050.

- The legislation would require banks to align financing with science-based emission targets,

- prioritize withdrawing funding from companies and projects that have a disproportionate negative impact on low-income and minority communities, and

- prioritize lending to companies that provide benefits to workers impacted by the transition to a clean energy economy.

- require the Federal Reserve to report to Congress on commitments made by banks and nonbank SIFIs to reduce financed emissions and make progress on their targets.

How HSBC, the largest bank in Europe was stopped!

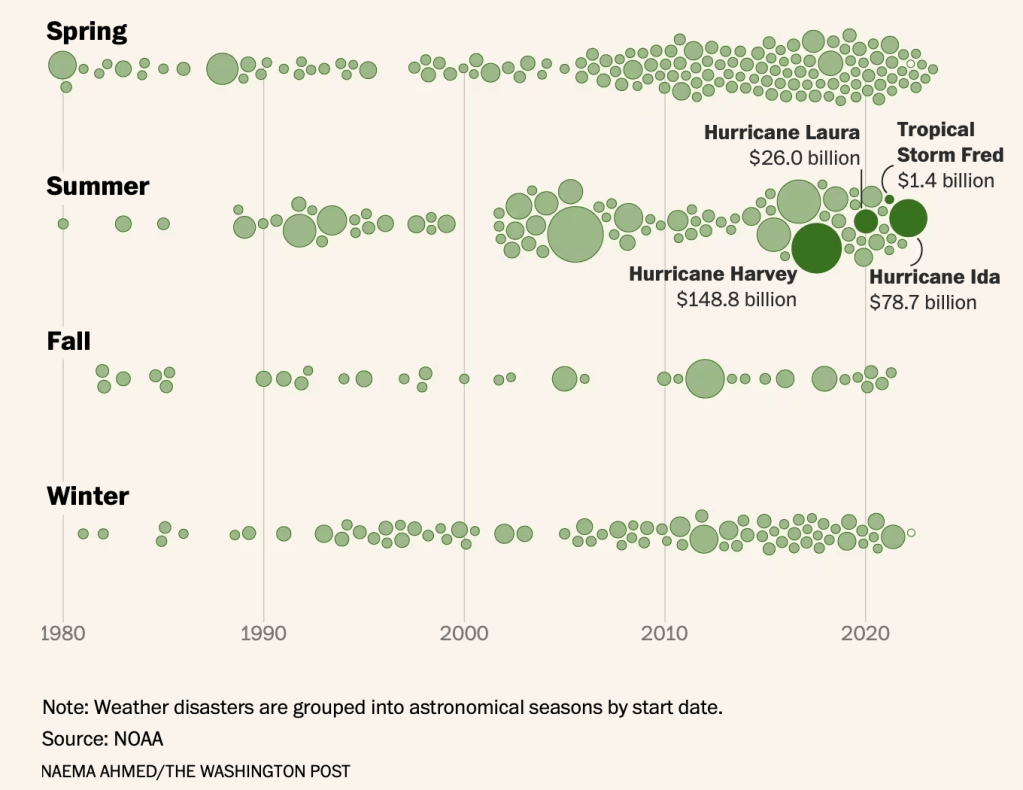

Does is seem like tragic weather events are happening more often?

Right now, homes, in parts of California, Florida, Louisiana, Colorado, Oregon and elsewhere are becoming uninsurable due insurers are going out of business. “Impossible” billion-dollar climate events are now happening on a regular basis. This is not our imagination. It’s got a graph. Meanwhile, last year alone, the banks poured $673 billion into fossil fuel companies, which made over $4 trillion dollars in profit!

Follow the money

Four U.S. banks (JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), and Bank of America (BAC) remain among the top five fossil-fuel financiers since 2016 and for 2022, according to the Banking on Climate Chaos report. Banks provided $673 billion to finance the fossil fuel industry last year, while oil and gas companies made $4 trillion in profits.

According to the White House, the “cost of climate and weather disasters in the United States last year totaled more than $165 billion—the third most costly year on record.” Not included is the value of those who died in climate-change disasters, increased healthcare costs or the trauma of lost communities. Worldwide, a company that insures other insurance companies estimate a loss of $23 TRILLION by 2050.

Banks are at risk as well…

(whistleblowers.org) By continuing to finance fossil fuel expansion and deforestation, financial institutions are increasing their exposure to new, climate-related financial risks. As the world seeks to meet the goals of the Paris Agreement, a wide range of financial assets will be impacted by “transition risks,” losses due to changes in law, policy, technology and markets related to the transition to a low-carbon economy.

As climate change intensifies, financial institutions will also face risks from the physical impacts of climate change such as extreme weather and rising sea levels. Extreme weather and rising sea levels could drive down the value of property held as collateral by banks, leading to a higher probability of borrowers defaulting on loans.

Banks, insurers and other financial institutions that are heavily invested in these industries, or industries that depend on fossil fuels such as transportation, may not be able to withstand the stresses of simultaneous company failures. An assessment of loan portfolios by the sustainability nonprofit Ceres found that more than half of syndicated lending of major U.S. banks is exposed to climate risk. According to Ceres, banks “have an imperative to disclose these risks, which could subject them to major lending losses in the event of a sudden and dramatic change in public, regulatory, or investor sentiment.”

These risks could also be transferred throughout the financial system. Through a process known as securitization, banks bundle loans and indirectly issue them as securities. As climate change begins to impact the assets that underly the loans, such as mortgages in flood-prone areas, this will create new risks for these securities.

The extensive and interconnected nature of climate-related risks mean that climate change presents a systemic risk, a risk that threatens the stability of financial markets. Transitioning to a low-carbon economy in time to meet the goals of the Paris Agreement will require a significant reallocation of capital. Without sufficient oversight and risk management, a poorly managed transition could lead to stranded assets and trillions in losses in the fossil fuel industry and tens of trillions of losses across the entire industrial sector, potentially triggering a recession.

We knew this was coming.

Despite Florida’s new policy of using Prager U’s climate-change-denial videos, the concept of climate started in the 1800’s, and was confirmed in the 1950’s. (Prager U’s “Climate Change” What do Scientists Say” was deemed “inaccurate and misleading.”) In 1896, a seminal paper by Swedish scientist Svante Arrhenius first predicted that changes in atmospheric carbon dioxide levels could substantially alter the surface temperature through the greenhouse effect.

In 1938, Guy Callendar connected carbon dioxide increases in Earth’s atmosphere to global warming. In 1941, Milutin Milankovic linked ice ages to Earth’s orbital characteristics. Gilbert Plass formulated the Carbon Dioxide Theory of Climate Change in 1956. (Scientific American) “Exxon was aware of climate change, as early as 1977, 11 years before it became a public issue, according to a recent investigation from InsideClimate News. This knowledge did not prevent the company (now ExxonMobil and the world’s largest oil and gas company) from spending decades refusing to publicly acknowledge climate change and even promoting climate misinformation—an approach many have likened to the lies spread by the tobacco industry regarding the health risks of smoking.”

in June 1988, NASA scientist James Hansen told a congressional hearing that the planet was already warming. At that time, experts agree that Exxon became a leader in campaigns of confusion. By 1989 the company had helped create the Global Climate Coalition (disbanded in 2002) to question the scientific basis for concern about climate change.

- (Public Citizen) Why We Need the Fossil Free Finance Act

- (crsreports) Congressional Research Service Report – How Climate Change May Affect the U.S. Economy

- (www.fossilbanks.org) Fossil Banks

- (CNN) The world’s biggest banks are still pouring money into fossil fuels

- (White House) The Importance of Measuring the Fiscal and Economic Costs of Climate Change

- (NYT) Climate Change Could Cut World Economy by $23 Trillion in 2050, Insurance Giant Warns

- (noaa.gov) Billion-Dollar Weather and Climate Disasters

- (livescience) When did scientists first warn humanity about climate change?

- (NASA) The Evidence for Rapid Climate Change Is Compelling

- (pressley.house.gov) PRESSLEY, MARKEY, TLAIB INTRODUCE LEGISLATION TO STOP BIG BANKS FROM FINANCING FOSSIL FUEL PROJECTS

- (Scientific American) DeSantis’s Florida Approves Climate-Denial Videos in Schools

- (Food&WaterWatch) On the Ground in Maui After Devastating, Climate-Fueled Fires

- (LATimes) How a perfect storm of climate and weather led to catastrophic Maui fire

- (CNN.com) News outlets went all in on Maui fire coverage. But did they miss a key part of the story?

- (Scientific American) Exxon Knew about Climate Change almost 40 years ago – A new investigation shows the oil company understood the science before it became a public issue and spent millions to promote misinformation